The Association of National Advertisers is coming for your ad tech margin.

That’s the TL;DR from the ANA’s second Programmatic Media Supply Chain Transparency Report, which published today.

It isn’t fair to summarize a report that spans 125 pages and took three years to complete into a few brash words (the report was also split in two, and part one published in June). It is, however, the all-caps message inside the report.

Advertiser advice

Advertisers have been cutting and supply-path optimizing away ad tech margins, for SSPs in particular, for years now.

But they’re not done.

One of the report’s concrete suggestions is to reduce SSP contracts to between five and seven vendors.

The ANA also estimates that the open web programmatic market is about $88 billion this year – 25% of which is straight-up waste.

Of that wasted $22 billion, $10 billion accrues to made-for-advertising websites and $12 billion represents ad tech margin efficiencies. Which explains recommendations from the ANA like reducing vendors, resetting contracts, establishing direct lines to media sellers and switching to inclusion lists.

Programmatic media suppliers in particular tend to skate by some brand marketers, according to ANA EVP Bill Duggan. Other channels are well understood or just less complicated, but he said marketers get “embarrassed to ask questions that could make them be perceived as being stupid” when the programmatic pros are explaining themselves.

Duggan elaborated that, in his estimation, any brand that spends $50 million or more online per year should have a “chief media officer” type role to specialize in media buying and supply chain ecosystems.

Who’s missing?

The ANA’s programmatic transparency reports, going back to blockbuster 2016 and 2017 reports with Ebiquity and K2 that shined a light on the many hidden fees marketers pay, have been impactful among advertisers. But they have also faced strong pushback from programmatic tech companies and ad specialists.

For one thing, Duggan said some vendors disputed the depth of the ANA’s list of brand participants, which were anonymous when the first report went out in June. The vendors asserted that, based on the quality of the campaigns analyzed by the ANA and its partners, the report may have a poor framing of programmatic because it used campaign data from less sophisticated brands.

This time, the ANA names 17 of the 21 participants, including Kimberly-Clark, Mondelēz, Walgreen’s, State Farm, Shell, Nissan, Dell, HP and more. So there.

There also is still a woeful gap in terms of vendor participants. The ANA needs vendors onboard for the report to really work. There were 67 advertisers interested in participating, Duggan said, but only the 21 had legal rights to secure necessary log-level data from their vendors. Sometimes, the advertiser doesn’t own the data (despite being generated by the ad budgets) or it isn’t contractually available.

Adform, Adobe Advertising and a third unnamed company were the only DSPs to participate.

Why so few – and so reluctant to be known – participants?

“I can’t really give you a good explanation why,” he said. “We thought it would be to the benefit of all of the supply chain participants to be noted in the report.”

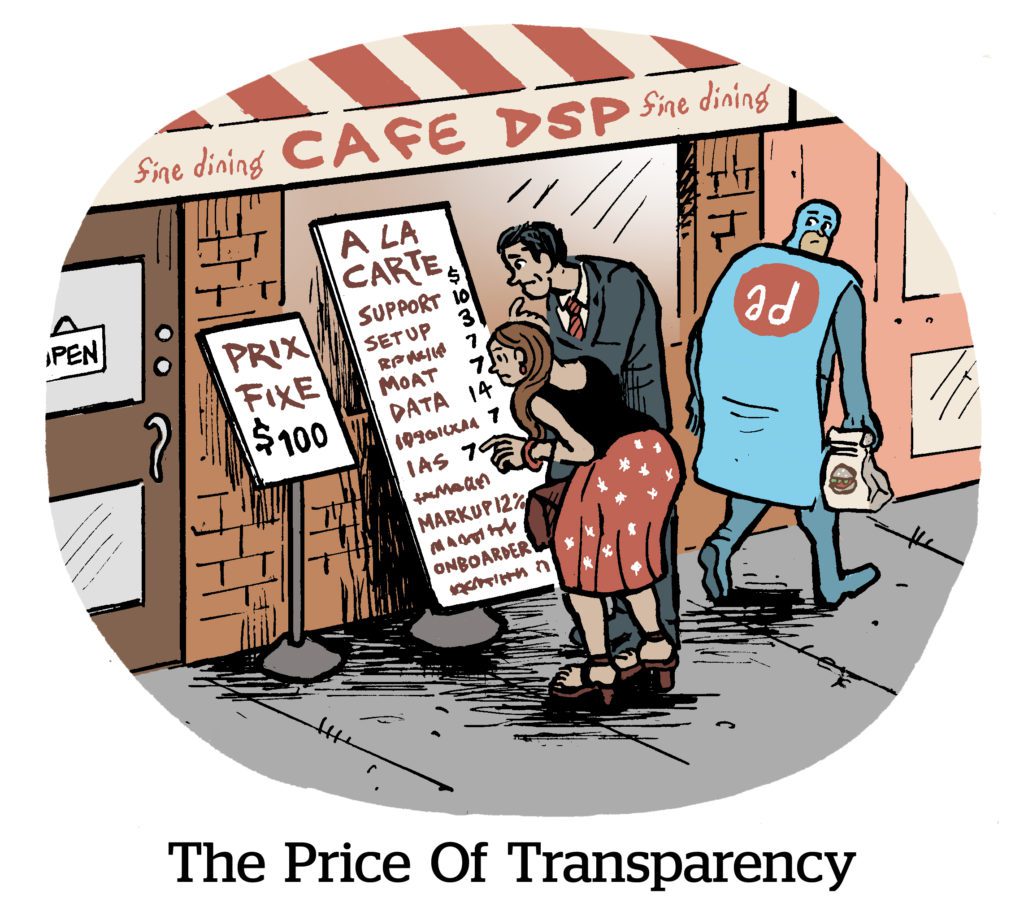

It is not so surprising, perhaps, that programmatic companies have not embraced a major advertiser initiative that has a stated mandate to understand and improve online ad transparency, but an on-the-ground goal of reducing ad tech costs.

Using more than the suggested five to seven SSPs, for instance, could result in advertisers bidding against themselves for inventory, Duggan said. It could also multiply supply chain emissions, which more and more advertisers are tracking nowadays.

“Everyone says they are supporters of transparency, until they’re the ones asked to be transparent,” the ANA report cites, attributing the quote to a statement overheard at an ANA conference.

Duggan echoed the same line when asked about the dearth of vendor participants.

What’s next?

For the ANA, a big priority will be membership education and training.

Even after the ANA released its report in June, which looked at MFA sites and the burst in MFA coverage, many marketers remain blissfully unaware of the topic.

“That made me realize that we have a job to do and we can’t simply drop a report,” Duggan said. “There needs to be an ongoing plan to educate members” through one-on-one training and webinars.

The discontented programmatic vendors would also like to see a similar transparency report with as rigorous guidelines for the walled gardens.

It is a cruel irony of this report, Duggan acknowledged, that because open web media can be evaluated by URL, format and log-level data, it becomes a target for reduction.

“There are other markets, the walled garden markets, that offer no transparency and are far larger,” he said.

Three years ago, when the ANA began the research process that would eventually become this two-part report, he said, the plan actually was to evaluate open web and walled garden inventory.

“It was a monster of a project,” he said. It became necessary to split them – just this version took more than three years, after all.

“So, we started with the open web,” he said, since that’s where the data was available.

While it’s possible an ANA walled garden transparency report may be released, it won’t be for a long, long time.

For now, going into next year, the focus will be on training and helping ANA brand members reduce their programmatic costs.