Innovid is a rare breed of data-driven ad tech company. It’s an internet-based tech startup founded in 2007 that focused from day one on … old-school television.

Innovid is a rare breed of data-driven ad tech company. It’s an internet-based tech startup founded in 2007 that focused from day one on … old-school television.

Fast forward 15 years to this Wednesday, and Innovid is going public under the ticker $CTV.

Innovid is the latest in a troop of ad tech players to hit the market in the past year, including Viant, Tremor, IAS, DoubleVerify, Zeta Global, ironSource, Kubient, Taboola and Outbrain.

And now that Innovid is public, people can stop asking if it’s for sale, CEO and co-founder Zvika Netter told AdExchanger.

“We can avoid the constant speculation that, ‘Oh, Innovid is going to be bought by some media company that wants to repackage it as the single source of truth,’” he said.

AdExchanger spoke with Netter about his plans for Innovid. TL;DR: He plans to go for the throat on Google’s ad-server business and try and drink some of Nielsen’s milkshake while he’s at it.

AdExchanger: Did Innovid focus on television advertising from the start?

NETTER: Some ads go to connected TV, some to mobile and desktop, but it’s all TV ads.

Our focus was always to enable the future of television over IP. It took longer than we thought, but here it is. It’s taking off big time, and that’s part of the reason we’re going public.

And you operate on the demand side?

We sell our platform to brands and agencies. It is the demand side, but sometimes people make the mistake of thinking of us as a DSP.

We’re the ad server and measurement platform for CTV. We don’t buy media or sell media. Our business model is pure tech fees. It’s an important distinction.

What’s your role in the CTV supply chain?

To start, the publisher or programmer shows up with their own ad server. FreeWheel and Google are the big ones. The brand then delivers the ads though Innovid, which sits between the brand or agency and the publisher.

But on CTV, it’s direct buys around 80% of the time with no third-party DSP or SSP.

Say you turn your Samsung TV on and run Hulu. The ad you see is not hosted by Hulu, like it would be on broadcast television. On CTV, it’s hosted by the ad server. That means Hulu is calling our servers for the ad that won or booked that impression, and we’re streaming it to your household.

And because we’re streaming to the Hulu app inside your Samsung TV, we get access to information used for billing, measurement and verification.

What about a programmatic buy?

A programmatic buy is more complex. If there is an impression on, say, Wired Magazine’s app on Roku, it calls an SSP like Magnite to sell it on the exchange, and The Trade Desk buys it. Again, we host the ad. The exchange or SSP calls for the creative, confirming The Trade Desk won the impression, and we serve the ad directly to the Roku platform.

We’ve been in this business for 14 years and never made a cent out of media. Most of the action is in the media space, where there’s a lot of very intense competition.

We believe it’s critical that there will be a single vendor that is independent and separate from the media, that is not a threat to anybody in the ecosystem and so can operate across media platforms.

Sounds a lot like Nielsen.

Nailed it.

Are you competing with Nielsen?

There are two legacy systems.

On the digital side, there’s Google Campaign Manager [formerly DoubleClick], which was built 20 years ago but was not for television.

And there’s the old broadcast TV world, aka Nielsen – but there’s no ad delivery in broadcast. You send the tape to the TV station, and then you rely on Nielsen’s panel, because nobody knows who actually saw it.

Nielsen is being challenged to provide solutions to this new world, and so I expect to see more brands and publishers rely on platforms like Innovid for CTV measurement.

As the ad server, we have accurate data, and we’re not in the media business, like Google, Roku, The Trade Desk, Magnite, Comcast or any of these guys, which buy and sell media and so cannot provide unbiased measurement.

We’re taking clients off of the Google platform, and we believe our measurement products over time will compete more and more with Nielsen.

Do you work with the panel startups TVision and Hyphametrics?

We know TVision well. I’m aware of those lawsuits. [Nielsen dropped separate patent infringement suits against TVision and Hyphametrics in November.]

Were you jealous, like, ‘Why am I not getting sued, too?’

Ha. No. But it is interesting to see. It’s good for us. It shows Nielsen is nervous.

But we’re certainly not trying to build a panel or compete with them. Our view is that the whole concept of a panel is flawed. And what you need is a good identity solution for the world, like household identity for CTV.

How big is YouTube supply as a part of your business?

Between 5% to 15% of our clients’ buys run on YouTube.

We cover YouTube because the creative needs to get there, and whatever data is generated needs to be collected and combined with Roku data, Hulu data and The Trade Desk data, etcetera.

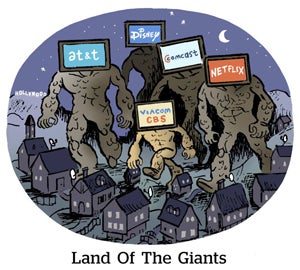

But traders are blocked from YouTube, as is the case with many other walled garden platforms in CTV, including Amazon Fire TV, Roku, Hulu, Comcast, Disney and others. We cover all of them.

For YouTube in particular, we have a measurement partnership that’s tied in to Google’s Ads Data Hub.

There’s no YouTube edge for Google’s ad server that you compete with?

No. And it wouldn’t be in Google’s interest – just the opposite. The Department of Justice and other regulators are looking closely to make sure special deal making does not exist across those businesses.

But it is true for media buying. The Google DSP has first-party advantages when it comes to buying and optimizing Google media. But that’s not something we do.

Would you ever get into media?

No, and brands don’t want it either.

Brands buy across seven, eight or more walled gardens, and they need one set of creative assets, not eight.

That was one of the big things during the pandemic. If you’re Toyota, you need real control over creative. Dealerships are opening in one state, closing somewhere else. That has to be centralized.

This interview has been edited and condensed.