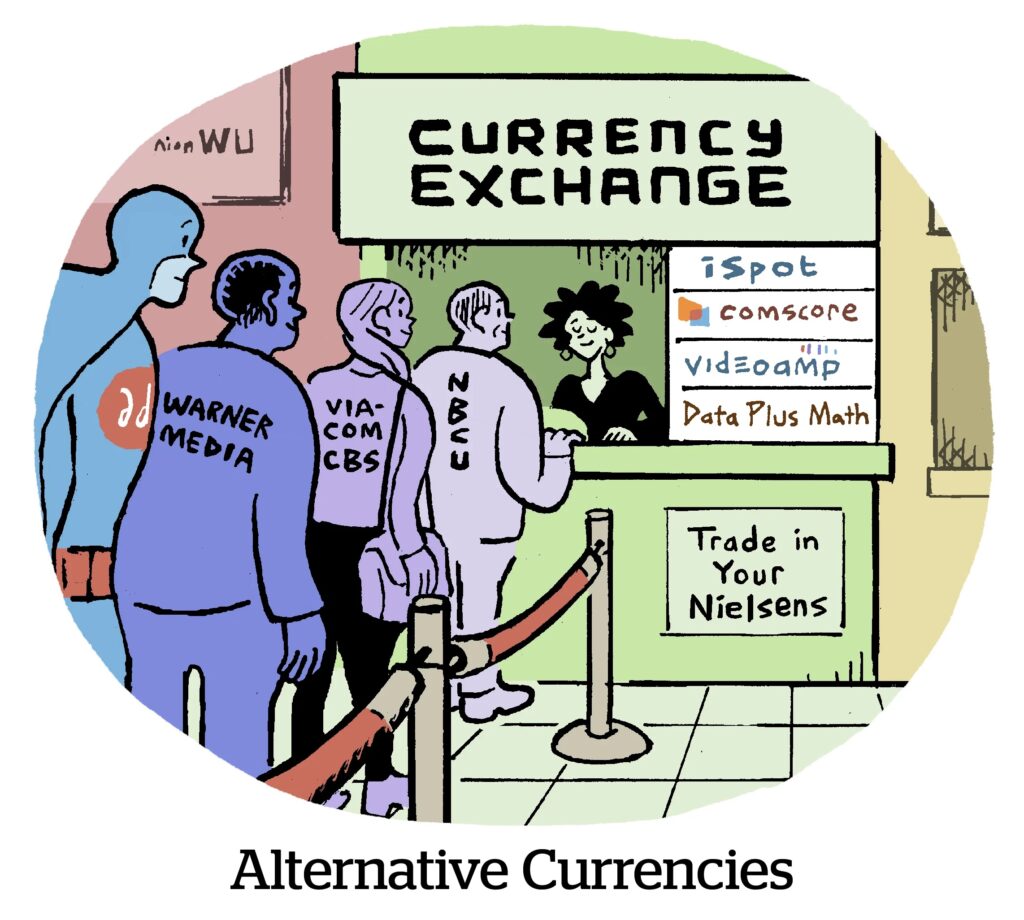

This year was a year of testing and learning for alternative TV currencies. (Yet again.)

But will the year of alt currency testing last as long as the highly anticipated year of CTV (as in coming up on half a decade)? Time will tell.

In the meantime, AdExchanger asked a handful of agencies and advertisers to (anonymously) name which they consider to be the top TV currency contenders going into 2024.

And the results are in.

VideoAmp, iSpot and, to a somewhat lesser extent, Comscore were named most often. Nielsen also remains in the running because it’s putting the finishing touches on Nielsen ONE, its new cross-platform measurement solution that includes big data.

One agency source was particularly gung-ho about the “momentum” behind VideoAmp, iSpot and Nielsen. But Comscore, not so much.

And a second agency source cited VideoAmp and iSpot as more ready to make guarantees on linear reach and frequency than Comscore.

Taking score

These sources didn’t elaborate on why they are less than impressed with Comscore, but it’s possible that agencies consider VideoAmp and iSpot (which launched in 2014 and 2012, respectively) to be more digital-savvy than Comscore, which formed in 1999, long before the streaming era.

For example, when NBCUniversal released its measurement vendor comparison last year, it gave Comscore a lower ranking for co-viewing than VideoAmp and iSpot, which both tout their partnerships with panel provider TVision. Co-viewing data will help agencies transition to buying and measuring connected TV ads – and eventually linear TV ads – based on impressions, which is similar to how they approach digital measurement.

But to its credit, Comscore received conditional certification for transparent census-level data from the broadcaster joint industry committee (JIC), just the same as VideoAmp and iSpot. (Nielsen still refuses to join the JIC.)

Having taken the pulse of buyers, AdExchanger asked VideoAmp, iSpot, Comscore and Nielsen to share an update on their data and methodologies as they compete for recognition and traction as go-to currency vendors. Here’s what they had to say.

AdExchanger: What is your household footprint in terms of viewership data?

VideoAmp: Nearly 40 million households and over 60 million TV devices.

ISpot: Roughly 30 million households and 82 million TV devices (before the acquisition of 605 in September).

Comscore: About 30 million households and 75 million TV devices.

Nielsen: Nearly 45 million households and 75 million TV devices (inclusive of big data).

Do your clients transact more on demo-based or advanced audiences using your currency?

VideoAmp: We currently conduct more transactions based on advanced audiences.

ISpot: Transactions against iSpot are mostly based on broader demos.

Comscore: Both.

Nielsen: Demos primarily.

What are some examples of programming distributors that license TV viewing data (set-top box and/or automatic content recognition) to your company?

VideoAmp: Comcast, Dish, TiVo, Frontier and Vizio.

ISpot: Charter, Vizio and LG.

Comscore: Six programming distributors and two ACR providers. [Comscore did not provide specific names in time for publication.]

Nielsen: Comcast, Dish, DirecTV, Vizio and Roku.

Do you use panels and, if so, how?

VideoAmp: We currently use TVision for person-level metrics that help inform our big data set. But, alone, audience panels are ineffective for accurately counting impressions across screens.

ISpot: We recently led a $16 million investment in TVision, and we use its co-viewing data to augment our existing household-level data set.

Comscore: We have a panel for digital channels, but it’s not part of our TV measurement solutions.

Nielsen: Our audience panels will continue to play a critical role in our currency solutions, including within Nielsen ONE, which also has big data.

What is something that makes your currency methodology unique?

VideoAmp: Our heritage as an ad tech company makes it easy for us to integrate new data, including through data activation systems such as Mediaocean, so we can support both planning and activation against advanced audiences.

ISpot: We focus on speed to be able to deliver second-by-second measurement for TV viewership.

Comscore: We track viewing data in every US designated market area by ZIP code, giving buyers and sellers representative viewership information at both the local and national levels.

Nielsen: Our panel-based national TV measurement service is accredited by the Media Rating Council.