Alphabet CEO Sundar Pichai started the company’s Q4 2022 earnings report on Thursday with an ominous message.

“It’s clear that after a period of significant acceleration in digital spending during the pandemic, the macroeconomic climate has become more challenging,” he told investors.

Although Alphabet is relatively more insulated than other ad-reliant platforms from the effects of a potential recession and Apple’s ATT privacy policies, it’s far from immune.

Alphabet managed to narrowly outperform in Q4, with total revenue coming in at $76 billion compared to $75.3 billion in the year-ago quarter.

And that’s the silver lining.

Bad omens

YouTube advertising was down from $8.6 billion to $7.9 billion, while the Google Display Network decreased by almost $1 billion YoY. Net income (which is to say, profit) dropped even more steeply, from $20.6 billion in Q4 2021 to $13.6 billion.

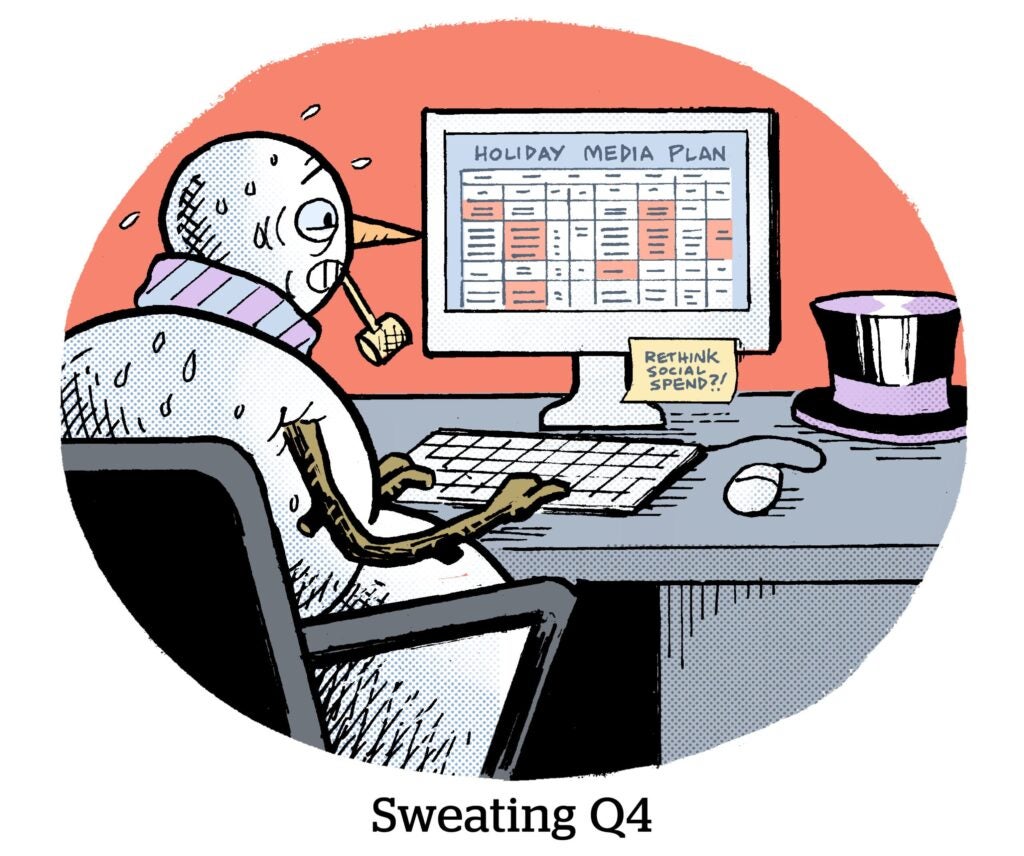

Advertisers accelerated their pullback in budgets from open web, search and YouTube, which Pichai noted is a trend that started to happen in Q3. But Alphabet had been waiting to see how the holiday season would pan out.

Not to mention the black cloud of the Department of Justice’s antitrust suit against Google, which dropped last week. No, seriously, not to mention it. The lawsuit did not come up on the call.

Room to grow

Still, Google has several big opportunities to increase revenue and to extract more efficiency from its business by bringing machine learning to its fleet of services.

The cloud platform has machine learning built in, said CFO Ruth Porat, and that same ML can be used to wring more efficiency from the company’s data servers, and will be incorporated into Gmail and other Google products.

Alphabet’s ML tech is also baked into Google’s Performance Max ad product, she said.

And YouTube remains a monster growth engine, despite its sluggish stats during the fourth quarter. In October, on Alphabet’s previous earnings report, Pichai said that YouTube Shorts were generating more than 30 billion views per day (which, by the way, is bonkers).

Fast forward just a few months, and YouTube Shorts is up to 50 billion views per day.

“There are many opportunities to build on our progress at YouTube over the years, starting with Shorts monetization,” Pichai said.

The Alphabet exec team also stressed the importance of retail and shopping more than during previous investor reports.

Three pillars

Google’s long-term value in retail and ecommerce is built on three pillars, said Chief Business Officer Philipp Schindler.

“First, we are on a multi-year mission to make Google a core part of shopping journeys for consumers and a valuable place for merchants to connect with users,” he said.

The second priority is to increase the number of merchants on the platform, especially SMBs. (Hear that, Shopify?). And, third, is the release of new retail ad products.

“From automation and insights to bidding tools and omnichannel solutions to AI-powered campaigns like PMax, we’re helping retailers hit their goals,” Schindler said.

Shopping and shoppable ads have always been a weak point for Google, which has tried its hand at launching different flavors of retail ad products, marketplaces and payment services.

But Alphabet isn’t going to fold on shopping and commerce just because it’s fallen off the horse a few times.

YouTube in particular has the chance to become a more shoppable platform, Schindler said, noting that “it’s still nascent, but we see lots of potential [in] making it easier for people to shop from the creators, brands and content they love.”