Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

What’s In Store?

Netflix’s latest effort to push ads onto subscribers is – you guessed it – a retail bundle.

The company is piloting a new package deal with French retailer Carrefour, Bloomberg reports. Customers in the French cities of Bordeaux and Rouen who sign up for Netflix’s ad plan will get 10% off Carrefour-branded products and free shipping on orders over 60 euros. Carrefour will expand the offer to other French markets if it takes off.

Streamers and retailers have been all about the bundled deal lately. Walmart+ customers now get a free ad-supported Paramount+ account, and, as of November, Instacart’s member program includes Peacock with ads.

Netflix is under pressure to grow its AVOD subscribers so it can compete with Prime Video, which launches ads on Jan. 29. Prime Video will default to ads, meaning that all 115 million Prime viewers will see ads at launch unless they pay extra not to. Netflix, meanwhile, is touting its … 23 million monthly active users worldwide.

It’s worth pointing out that in Netflix’s case, MAUs refer to individual profiles within paid accounts, so 23 million is optimistic.

The Slowest-Motion Crash And Burn

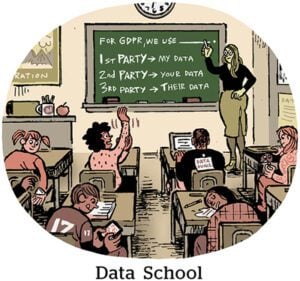

Now that Chrome’s third-party cookie deprecation deadline is, like, a thing, f’real this time, DSPs and marketers are seriously contemplating the prospects of online advertising without cookies.

It sounds like a joke after all these years, but many marketers will be shocked to discover that the end of third-party cookies means a complete redesign of their digital marketing programs.

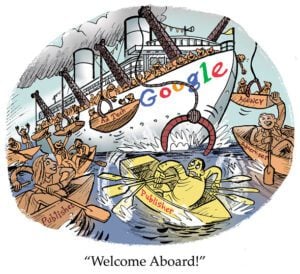

Companies like RTB House and Criteo have invested a lot of time and people hours to test and develop DSP products for the Privacy Sandbox over several years by this point.

There still remains an open question, however, about whether the APIs in the Chrome Privacy Sandbox will gain enough adoption to become a default way for ad buyers to target and attribute campaigns on the web.

Regardless, Chrome third-party cookies are on the way out.

And, as Digiday reports, relatively few brand marketers have the Chrome privacy APIs on their radar.

Why? Because their cookies work – first-party cookies aren’t going anywhere. And most marketers don’t want to know how the sausage is made. They simply expect the programmatic tools they’ve always been using to continue to function smoothly.

Battle Of The Buy Buttons

Is it possible that Shopify and Amazon’s competition for small and third-party merchants is becoming, dare we say, a coopetition?

For the last few months, the dueling ecommerce platforms have been working together on payment processing, The Information reports. Specifically, Spotify has taken over some Amazon Pay transactions through a feature called “Amazon Pay with Shopify Payments.”

On March 18, Shopify will stop supporting the previous version of its Amazon Pay integration in the US, at which point Shopify merchants that want to use Amazon Pay buttons will have to adopt Shopify Payments.

As huge as Amazon is, it’s not a giant in the online checkout space. PayPal handles 58% of US online payments compared with Amazon’s 2%. Shopify-created Shop Pay commands only 6% of online payments in the US, while Apple Pay has 21%.

Last week, Amazon laid off 15 of its Amazon Pay employees, which could indicate it’s pulling away from payments.

Previously, Amazon and Shopify discussed Shopify taking the reins for Buy with Prime payments while Amazon managed the fulfillment. But the plan never came to fruition. For now, Amazon is still on checkout duty for Buy with Prime sellers with the help of a Salesforce commerce cloud integration.

But Wait, There’s More!

New CNN boss (and former New York Times boss) Mark Thompson says the news needs to start exploring and experimenting with direct-to-consumer payments. [WSJ]

Amazon widens its sports footprint with a minority stake in Diamond Sports Group, the operator of several major regional sports networks. [Financial Times]

DoubleVerify will introduce brand safety and suitability measurement for Facebook and Instagram feeds and Reels. [B&C]

You’re Hired!

A+E Networks hires Fox vet Toby Byrne as EVP of national ad sales. [Ad Age]

Publicis-owned Razorfish promotes Sisi Zhang to chief data and analytics officer and rehires Matt Lefever as COO. [blog]

Havas Media hires Jamie Seltzer as global EVP of its data and analytics service. [release]

Carbon intelligence platform Cedara brings on Christoph von Reibnitz as VP sales in German markets, and Andrea Caporlingua as VP of sales for France and Belgium. [release]