Hi readers!

I’m AdExchanger Senior Editor James Hercher, here with the first 2024 edition of the AdExchanger Commerce Newsletter. And why not start with a bang.

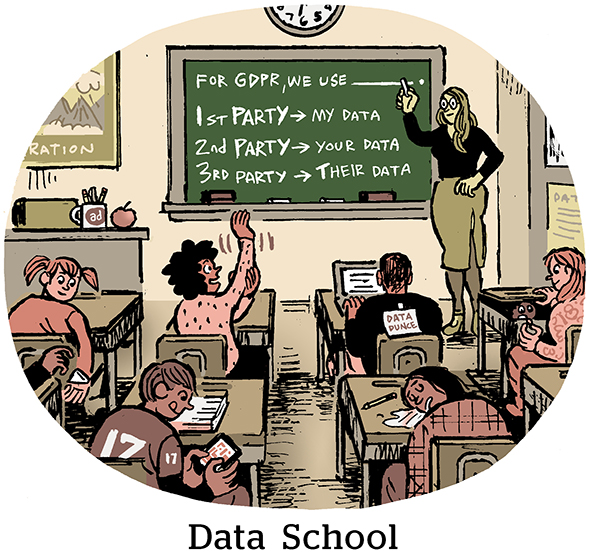

This week, we’ll consider the possibility that, perhaps, the first-party data revolution is a dud.

Digital native and direct-to-consumer brands are built on thumb-stopping hooks: mattresses that emerge from impossibly small cardboard cocoons, peanut butter that drizzles like syrup, luggage that charges your devices. But their true differentiation from legacy brands was supposed to be their data-driven ethos and first-party connections with customers.

First-party data was going to change everything.

Except, now, many of these brands that epitomized the digital and data-driven mentality are suffering brutally.

Allbirds, the upstart shoe brand with a sustainability edge, went public in late 2021 above $20 per share. It barely clears $1 at the moment. Solo Brands, an ecommerce brand aggregator that trades under the ticker DTC, is also down from more than $20 to below $3 as of reporting.

And those are the success stories.

The once-promising DTC marketplaces Zulily and Farfetch are circling the drain. SmileDirectClub, an early standout, declared bankruptcy, as did DTC apparel startups Parade and Lunya. A private equity firm bought Dollar Shave Club from Unilever, which had acquired the DTC brand for a cool $1 billion in 2016, for undisclosed terms (meaning it was an inconsequential sum not to be reported in earnings). Walmart sold Bonobos for $75 million six years after buying the DTC clothing brand for $300 million.

And that’s just a sliver of the DTC brand blowback from the past year alone. Far more brands are quietly folding up shop.

So, what happened?

The cost of data

There are myriad reasons behind any business failure.

Many DTC brands raised money or went public during a boom cycle, while investors bet on growth. When macroeconomics turned sour, investors lost their taste for unprofitable DTC darlings.

But the failure of so many DTC brands raises the uncomfortable question: Were we wrong about the value of first-party data?

“It’s something we’ve been talking about a lot lately,” Alex Birchmeier, Conagra’s senior director of marketing activation, recently told me when asked whether the company was rethinking its own first-party data investments.

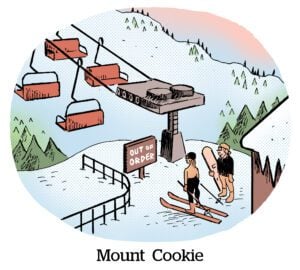

The promises of first-party data and individual personalization are alluring, he said. What vendors don’t mention is its super-fast half-life: first-party cookies and device IDs disappear, IP addresses change, emails turn out to be placeholder spam accounts. And through it all, ad blockers prohibit many one-to-one marketing use cases.

So you’ve added a customer data platform (CDP), maybe a new cloud collaboration vendor, some cloud-based mar tech tools, plus a measurement vendor to gauge those investments.

Congratulations! Now you need to hire marketers who can use those tools – and data scientists, because who else can analyze that first-party data?

There is clear, tangible value in possessing first-party data. But with that also comes a murkier and intangible cascade of subscription technology and hiring costs that brands are starting to turn against.

Retailers pay rent. And brands pay rent, in a manner of speaking, to sit on store shelves.

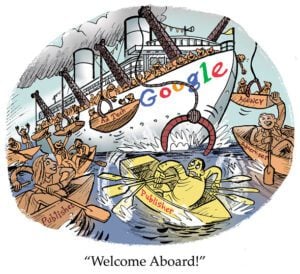

But DTC brands pay rent, too. They pay it to Meta, to Google, to Snowflake and AWS, to Shopify and Klaviyo and to many other subscription tech solutions.

The potential vendor implosion

DTC startups have been unable to unseat legacy grocery store brands and are reaching the ends of their VC backing. And the same can be said of the startup tech vendors that undergird the data-driven DTC economy.

The independent tech vendors that enable first-party data activation are scrambling to compete – or at least co-exist – with the incumbent tech platforms.

Consider the CDP category. The idea of real-time, user-level personalization was built on the expansion of CDPs.

A CDP was considered a must-try and must-have tool in every mar tech stack five years ago, a Fortune 100 CPG brand marketer told me during the NRF Retail’s Big Show conference in New York earlier this month.

Now … “meh,” he said.

The big cloud marketing companies – Salesforce, Adobe and Oracle, namely – took over the CDP brand, at least in terms of mind share for marketers, according to a large beverage brand marketer. But those cloud CDPs were simple activations, like triggering email alerts or customer service text messages.

“Why do I need a special vendor for that?” she said.

Which is why CDPs have been hoovered up as point solutions in larger SaaS bundles, like Twilio’s acquisition of Segment or Salesforce buying Datorama and Evergage.

But the biggest challenge to the CDP value prop comes from the cloud infrastructure providers. Last summer, AWS introduced a product called Entity Resolution that – not to beat around the bush – replaces most of the baseline purposes of a CDP at a $0 cost.

CDPs might have proprietary data or their own special sauce in terms of marketing know-how and integrations. But AWS makes the point quite clearly that the shiny, expensive CDP in your toolkit may actually be worth … nothing.

First-party for who?

A similar existential challenge is playing out for data clean room and data collaboration vendors.

LiveRamp recently bought Habu, merging two of largest independent vendors in that ecosystem in a joint effort to compete alongside biggies like Google Cloud, AWS and Snowflake.

And while the overall growth of cloud computing costs accrue to Google, AWS and Snowflake – who earn more when more data is used – the independent data vendors are leashed by marketers who want to control first-party data costs, rather than unleash first-party data potential.

The shoe brand ASICS, for instance, is a blue-chip client for Habu. But while ASICS’ Google cloud bill must go up and up, the company can manage Habu costs by limiting the data it uses to marketing experiments. If Habu housed the entire data warehouse or used ASICS’ entire first-party data supply, the compute costs would skyrocket.

Meanwhile, AWS and Google Cloud recently released data clean room and collaboration tech meant as a baseline alternative for those indie vendors. And – you guessed it – the AWS and Google versions are priced at $0.

The big cloud platforms aren’t aggressively pitching to disintermediate CDP and data collaboration vendors, the same major beverage brand marketer told me at the NRF show. “But the prices for their own CDPs and clean room products speaks volumes.”

What those platform prices are saying, she added, is that the supposed first-party data revolution is something that happens on Amazon or Google, not inside your own business.