VideoAmp is the latest TV measurement contender to get slapped with a lawsuit from Nielsen.

Nielsen’s suit against VideoAmp, filed last week in Delaware court, accuses its rival of infringing on two patents granted to Nielsen in the past two months. The patents cover technology Nielsen uses to collect and report TV viewing data, such as determining session duration and whether TV sets in panel households are turned on.

The century-old ratings giant has been struggling to maintain its dominance since it lost accreditation from the Media Rating Council for its national and local ratings after undercounting audiences in 2021. It took until 2023 for Nielsen to regain accreditation for its national ratings.

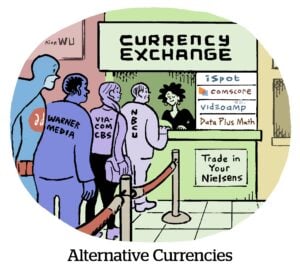

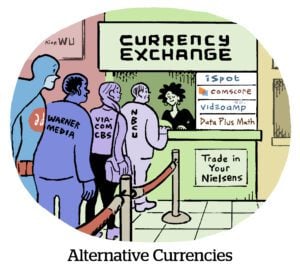

Meanwhile, the rise of alternative measurement currencies over the past two years has also been posing a threat to Nielsen’s future (even if adoption is moving a bit slowly).

This complaint against VideoAmp is the ninth patent infringement lawsuit Nielsen has brought against rival companies in just three years.

Breaking a sweat

In other words, Nielsen looks nervous.

Since 2021, Nielsen has sued TVision, HyphaMetrics, audio metadata vendor ACRCloud and measurement provider TVSquared just one month after it was acquired by competitor Innovid.

(Nielsen actually hit TVision and HyphaMetrics with multiple patent infringements in 2021, although one of the cases against TVision was dropped in January after a ruling indicating that a Nielsen patent may be invalidated in a review later this year.)

So why sue VideoAmp, one of its biggest adversaries, now? VideoAmp has been stumbling recently as a result of financial missteps and perhaps makes for an easy target. A pending lawsuit creates undetermined costs for VideoAmp that investors would likely prefer to avoid.

But Nielsen says it’s all just protocol.

“As is standard business practice, [Nielsen] will continue to vigorously defend our intellectual property rights to the fullest extent possible,” a spokesperson told AdExchanger when asked about its suit against VideoAmp.

VideoAmp declined to provide a comment for this story.

Déjà vu

Though the patents in question are new, the nature of Nielsen’s VideoAmp lawsuit echoes those already filed.

Specifically, Nielsen claims that the tech VideoAmp uses to collect return-path data from TV sets and the methodology it uses to process the data, such as determining session duration and whether TV sets are turned on, are an infringement of Nielsen’s recent patents. The fact VideoAmp has been using this data to sign major deals with programmers and agencies constitutes “irreparable damages” for Nielsen, according to the lawsuit.

Similarly, Nielsen’s dual lawsuits against HyphaMetrics and TVision in 2021 both focus on technology used to track TV viewing in panel households.

For example, Nielsen called out HyphaMetrics for tech it uses to tell whether a TV device is turned on or off, which determines whether to activate or turn off in-home meters. TVision, meanwhile, is being sued for the method it uses to monitor who within a household is watching TV and later connect that information with ad exposure data.

In both cases, Nielsen claims the technology its competitors are using to track household TV viewing infringes on Nielsen patents.

The fine lines

But any company trying to gain market share in TV measurement can’t do so without collecting and organizing viewing data accurately.

It’s therefore unclear how Nielsen’s competitors can continue measuring TV consumption without getting caught in the incumbent’s crosshairs.

They’ll need to prove their methodology is different enough from Nielsen’s patented tech.

HyphaMetrics, for example, asserts it uses an entirely different technique and hardware than Nielsen to measure in-home viewing. While Nielsen provides panel homes with devices people must engage with (such as Portable People Meters), HyphaMetrics sends its households a router-like device to install that passively measures viewing using Wi-Fi and Bluetooth. HyphaMetrics then sells or licenses its data to agencies, programmers and other measurement companies.

In VideoAmp’s case, it accesses set-top box and automatic content recognition data from broadband, cable and smart TV companies (such as Comcast, Dish and Vizio) and matches that data with its identity graph. It also partners with TVision for help determining who in a household is watching TV.

It will take some time for court proceedings regarding this lawsuit – and the others filed – to result in concrete findings or decisions. Patent infringement litigation could take at least three years.

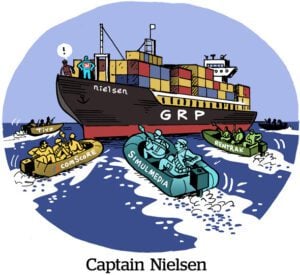

In the meantime, competition in the TV measurement space is at a boiling point, and it’s only getting hotter.

Which begs the question: Who will be next on Nielsen’s hit list?