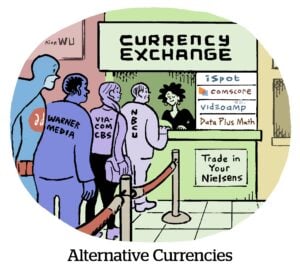

Television audience panels are having a moment right now, as TV ad measurement hits an inflection point.

TV advertising companies are paying attention to panels lately, because panels can address audience gaps that bigger census-level data sets often miss, like determining who in a household was likely watching TV. Panels are also necessary ingredients to determine specific metrics, like attention-based measurement.

Take HyphaMetrics, a measurement startup that launched in 2020 to supply panel-based viewing data to brands, programmers and other measurement providers.

The industry has come to a consensus that panels and big data work better together, HyphaMetrics Founder and CEO Joanna Drews told AdExchanger. Which is why the company announced in January it will start integrating its own data with viewing data from measurement provider Samba TV as part of a new panel offering later this year.

The new panel will include data from 5,000 households by the end of this year and could grow to as many as 10,000 households. HyphaMetrics will also recruit Samba TV households for its panel.

But make no mistake: HyphaMetrics is not trying to become a currency, Drews said – the company and its new panel sit squarely in the measurement camp.

Drews spoke with AdExchanger.

AdExchanger: What role does HyphaMetrics play in the measurement space?

JOANNA DREWS: We sell viewing data to brands and programmers, which they use to help plan campaigns. Separately, we also license our data to currency providers that use it to validate their own data and include co-viewing within their products.

We’re not here to be a currency. We’re here to help fuel whichever currencies programmers and buyers choose by providing them with data.

How does HyphaMetrics collect audience data?

We have a router that panel households can install themselves. It passively identifies who is in the room using Wi-Fi and Bluetooth to detect other devices while the TV is on. That way, we’re able to collect co-viewing data.

The passive nature of the data collection is also important because, if consumers within panel households have to take action to participate, they may cut corners, which reduces data accuracy.

[Editor’s note: For example, an anonymous source that was part of a Nielsen household recently said their family members were sharing the same Portable People Meter.]

What about content viewing data?

[We have] an in-house tool that uses AI to recognize what titles are playing at the episode level by deciphering information from video streams such as app or network, channel logos, device type, brand sponsorships and product placement.

How is this method different from automatic content recognition (ACR)?

We train our tool with AI to learn and remember information about content metadata so it can recognize channels and titles in real time, whereas ACR technology has to go back and match metadata to a reference library each time, which could take several days.

What does the recent partnership with Samba TV change about the company’s position in measurement?

Our goal has always been to provide the marketplace with representative viewing data to help media buyers and sellers understand TV consumption across walled gardens [as in, programmers or smart TV companies with an ads business].

Partnering with Samba gives us access to more census-level data, such as identity and ad exposure data, that widens our scope of TV audiences. And it improves our go-to-market strategy because it’ll be easier for us to calibrate with other census-level data sets in the future.

Speaking of calibration, does HyphaMetrics consider its new panel to be a “calibration panel”?

Calibration is one use case of our panel, so we don’t want to confine ourselves to just calibration.

What are the other use cases?

Clients use us for competitive intelligence. Advertisers are able to see where their competitors ran ads, while programmers can compare their content distribution and viewership with their rivals.

Our panel can also address identity resolution by providing a fuller understanding of the consumer or to determine co-viewing.

This interview has been lightly edited and condensed.

For more articles featuring Joanna Drews, click here.