The TV industry subsists on three-letter acronyms. So here’s another one to add to your collection: RPD.

Return-path data (RPD) is viewing information processed by a TV device, such as a cable or satellite set-top box. Measurement companies use RPD to help advertisers and programmers figure out where ads ran and who saw them based on viewing session details.

The term RPD can sometimes also refer to data from other devices that capture TV viewing, such as smart TVs and gaming consoles, making it an “umbrella term” for any device-level information about TV viewership, said Pete Doe, chief data officer at Nielsen.

But although the definition of RPD technically encompasses automatic content recognition (ACR), which tracks viewing on smart TVs, there are nuances that set ACR apart. It’s therefore “convenient” to distinguish ACR from set-top box data, Doe said.

He added that Nielsen’s clients typically use the term RPD to describe only set-top box data.

Return policy

Set-top box data includes a hashed household ID, the TV channel the household was watching and a timestamp. Measurement companies get this data via direct contracts with cable and satellite providers.

But RPD is “messy,” said Carol Hinnant, chief revenue officer at Comscore, because a lot of other data must enter the mix to make RPD useful.

For example, measurement providers have to first compare RPD with program schedules to determine the network and channel as signaled by a set-top box, Hinnant said.

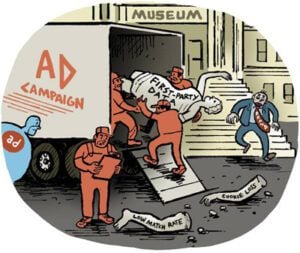

Measurement companies must then deduce the household behind the hashed ID, which is based on subscriber details a cable or satellite provider has but can’t disclose for privacy reasons (such as home address).

These hashed IDs typically get matched with third-party identity providers, such as Experian, to uncover information about TV viewers for audience segmentation, including household income, credit information, ethnicity and education level. Advertisers can use these insights to refine their audience targets like, say, to find more high-income households that watch sports.

Nielsen also uses its audience panels to correct inconsistent data, because it can see the age, gender and preferred language of people in panel households.

If Nielsen picks up on a Spanish-speaking household watching Univision, for example, and a third-party data provider identifies that household as non-Hispanic, it’s possible the external data set includes wrong or incomplete data.

Once measurement providers infer who watched what, they can use RPD to determine the reach and frequency of TV ad campaigns.

ACR vs. STB

Still, set-top box data isn’t the only data measurement providers use to track TV ad exposures.

They also use ACR, a subset of RPD that works differently from set-top boxes.

ACR is technology within smart TVs that learns to recognize content by keeping a reference library of what’s playing on the screen. But while ACR can identify content beyond the limits of a program guide (aka on-demand streaming), it can’t identify what it likely hasn’t seen before, like content on hyperlocal stations.

Access to ACR is also beholden to the terms of distribution agreements between smart TV companies and streaming services, according to Hinnant. Some streaming platforms don’t allow content distributors to track viewing within their apps, such as Netflix.

One advantage of ACR for advertisers is that it only tracks activity when a TV is turned on, unlike set-top boxes that may still be running even when a TV is off. The TV industry heralds ACR as an answer to cross-platform measurement because of this distinction and its ability to identify show titles quickly.

But ACR and set-top box data each have unique strengths and shortcomings, Doe said, which is why, ideally, TV advertisers should be making buying decisions based on both.