Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

Take Initiative

Meet yet another TV ad standards initiative.

GroupM announced the Ad Innovation Accelerator on Thursday, which it hopes could lead to more nonstandard streaming ad formats – and technical standards for those formats to make sure they can run on any device, Ad Age reports.

Participants include media sellers like Disney, Roku and YouTube, plus streaming ad tech companies BrightLine and KERV.

The working group will meet with GroupM clients to discuss new ad formats and performance expectations.

Advertisers want more interactive and shoppable ad spots, for one, partly to improve attribution and analytics from CTV campaigns. The challenge is that innovative ad formats “don’t necessarily fit neatly into a traditional media budget,” Mike Fisher, GroupM’s executive director of investment innovation, tells AdExchanger.

It doesn’t help that advertisers approach measurement in different ways, which is why GroupM wants its clients to be directly involved, Fisher says.

The process will take time, but Fisher says he expects initial discussions to influence upfront negotiations this year.

Go Bid Or Go Home

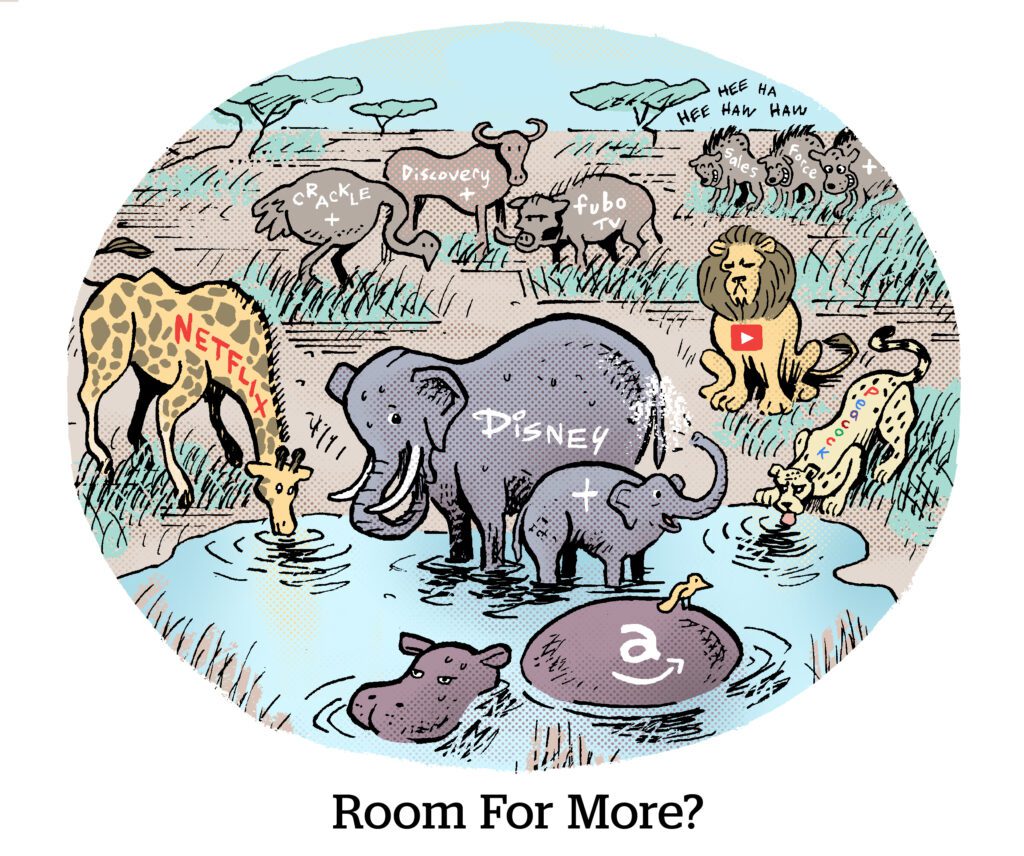

Speaking of CTV, rival studios and streaming services are battling it out for new advertisers.

The most straightforward way to get new demand is via programmatic, says Rita Ferro, president of global advertising at Disney, during a virtual fireside chat on Thursday.

The Mouse House now has integrations with 30 DSPs to make sure its inventory is accessible for practically any buyer, Ferro says. Many digital-native marketers buy ads programmatically, so increasing biddable inventory should help win incremental demand and, therefore, gain market share.

Competition for ad dollars among streamers has undoubtedly reached a boiling point. While Amazon’s Prime Video will be a “formidable competitor,” Ferro claims Disney still has more scale across ad-supported streaming supply. But Prime Video is about to gain as much as 115 million ad-supported subscribers when it defaults Prime Video viewers to seeing ads in a few weeks.

Disney, meanwhile, has plans to bolster its position in the AVOD race.

It will share more details during its Tech & Data Showcase at CES next week in Las Vegas. AdExchanger will be there, so stay tuned.

Newsed And Abused

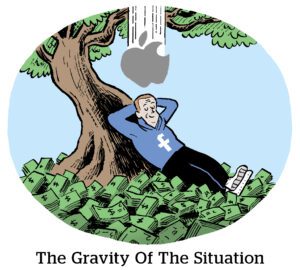

Publishers must balance being part of an audience revolution (the dot-com boom, mobile boom, social boom, etc.), with the downsides of giving away content that profits others.

This point is topical again because large language model operators (OpenAI, plus Google and Apple) are striking deals with news publishers to inform generative AI software.

Publishers have piddling offers from OpenAI (mostly $1 million to $5 million per year), with larger deals from Apple (tens of millions annually) that give Apple greater rights to use data as it sees fit, The Information reports.

News companies are structurally disadvantaged in dealmaking, though.

For one, LLMs use web crawlers that simply scrape the Times and other sites, including those with paywalls. OpenAI can mostly avoid the problem if its model can ingest news reporting without plagiarizing the content. So OpenAI won’t spend hundreds of millions of dollars to license news stories.

And despite being greatly overmatched, publishers can’t coordinate for advantageous deals, like by aligning with Apple to force better offers from Google or OpenAI – that would be an antitrust violation.

Publishers could do better by working together, but each is stuck fending for itself.

But Wait, There’s More!

VideoAmp CEO steps down as the company lays off 20% of staff. [Ad Age]

Ad buyer trepidation from 2023 seems to be carrying over into this year. Here’s how media execs are adjusting their plans in response. [Digiday]

Index Exchange donates a testing tool to the IAB Tech Lab’s Privacy Sandbox Task Force. [release]

Instagram creators say the platform’s new features miss the mark. [Bloomberg]

TikTok Shop hikes seller fees and axes some subsidies. Now begins a tougher road to ecommerce growth. [The Information]

You’re Hired!

Melanie Zimmermann, former head of the Macy’s Media Network, will now lead Criteo’s global retail practice. [release]

Jeanine Poggi named editor-in-chief of Ad Age. [Ad Age]