Someone streaming from their sofa doesn’t give a hoot about the difference between CTV and OTT – but the nuance matters to advertisers.

On Thursday, identity resolution company MediaWallah announced a new identity verification product to help standardize labels and definitions for CTV inventory. The ad industry still struggles to classify what counts as CTV and what doesn’t, said CEO Nancy Marzouk.

When MediaWallah was building its CTV product suite last year, the company found that data vendors were mislabeling at least 30% of CTV data from non-CTV devices as CTV IDs.

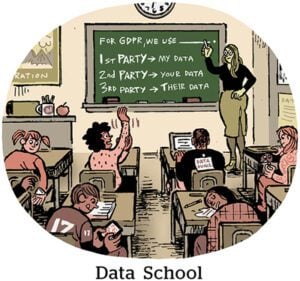

CTV specifically refers to TV screens. When streaming happens on a mobile or desktop device, that’s considered over-the-top (OTT), a subset of CTV.

While both CTV and OTT are streaming, advertisers have to differentiate between device types to target campaigns effectively.

Setting standards

MediaWallah’s new product verifies CTV identifiers by filtering out mislabeled IDs from data vendors.

To do this, MediaWallah compares data it licenses from different data brokers that have SDK integrations into streaming apps, such as ad exposure data, IP address and device and browser type. If MediaWallah can’t find a match for a particular ID, that’s usually a good sign that the identifier is actually an ad ID from a non-CTV device, said Chief Data Officer Bobby Atefi.

Part of the problem is that some data vendors include OTT viewing, like someone watching “Yellowstone” on the Paramount+ mobile app, under the CTV umbrella – which is misleading and “muddies the pool of IDs” advertisers use for streaming, Atefi said.

To help clarify matters, MediaWallah is sticking to a standardized definition of CTV as content on a smart TV (think Samsung, Vizio, LG or Roku TVs).

Cleaning up

But confusion over nerdy definitions isn’t the only culprit behind poorly labeled data. In some cases, the data itself is bad.

In October, data validation company Truthset released research suggesting nearly half the data that advertisers use for CTV ad targeting – such as email and postal addresses – is flat-out wrong. Vendors process and aggregate data before selling it to other companies, so it often looks quite different by the time it’s made available to an advertiser for targeting, Marzouk said.

Privacy regulation is also restricting the use of certain signals TV advertisers rely on for targeting and measurement – particularly IP addresses, a linchpin of TV advertising.

The pace of privacy regulation shows no sign of slowing down, but MediaWallah hopes setting more standards for validating CTV data will help advertisers improve campaign results despite the looming threat of signal loss.

Learning to compartmentalize

Initially, MediaWallah expects advertisers to use its new CTV product to create more detailed audience segments based on device type, Marzouk said, since targeting and measurement both vary by device.

For example, targeting and measurement for CTV ads is tied to the household, whereas other digital platforms allow for targeting on a one-to-one basis. But with a better understanding of which devices belong to which households, advertisers can manage frequency capping by household and earmark more of their budget to reach new viewers.

Campaign results also differ between CTV and other channels.

Because people exposed to campaigns on smart TVs usually convert elsewhere, CTV ads often appear to underperform if they’re held to the same standards as mobile ads. (That’s why interactive and shoppable ads are still more common on web and mobile than on CTV – for now, at least.)

But if advertisers can properly disentangle CTV data from the rest of their campaign data, Marzouk said, they can more effectively plan their messaging, targeting and measurement strategies.

And, naturally, Marzouk said, improved campaign results will encourage more marketers to give CTV a try.