AI-driven performance optimization is all the rage these days.

Now, Yahoo is getting in on the action with the release on Tuesday of Blueprint, a new feature for its DSP that offers midflight optimization recommendations to meet campaign goals and help advertisers determine a person’s lifetime value and likelihood to convert.

The solution relies on first-party behavioral data pulled from Yahoo’s owned-and-operated sites, as well as purchase and location data collected from logged-in users with Yahoo email addresses. While AI capabilities aren’t new to Yahoo’s DSP, Blueprint can surface algorithmic recommendations for multiple campaigns within a single dashboard.

Having shut down its SSP in February, Yahoo is focusing more on helping advertisers drive campaign performance, said CRO Elizabeth Herbst-Brady. Alongside Yahoo’s recently released Backstage direct-to-publisher buying solution, this launch is the latest in its strategy to prioritize its DSP business.

Response to market evolution

Yahoo’s new approach reflects an evolution in the programmatic marketplace, said SVP of product strategy and management Adam Roodman.

The reason Yahoo got out of the SSP business, he said, is because many publishers now have the programmatic know-how to monetize their inventory effectively by changing their header-bidding wrappers. As a result, they’re less reliant on publisher tech platforms.

Similarly, the Blueprint launch is in response to increasing sophistication on the buy side, Roodman said.

Today, advertisers have a ton of data at their disposal and are well versed in activating against consumer insights, but they don’t want to be mired in the tedium of troubleshooting campaign performance and testing different audiences. They, like many exploring AI’s capabilities, want algorithms to shoulder that burden instead.

That’s exactly how experiential and digital agency Red Moon Marketing has been using Blueprint in early tests, said its digital marketing director Benjamin Cao. Optimizing across multiple campaigns within a single dashboard has freed up about an hour a day for Red Moon’s team, which can now be spent on client outreach and internal education efforts.

Blueprint starts with an advertiser’s KPIs, then makes recommendations for audiences or PMPs to help meet performance goals. The recommendations appear within the dashboard alongside projections on how targeting different audiences will affect those KPIs. Rather than these recommendations being implemented automatically, clients have the ability to opt in to any new campaign strategies.

For example, if Red Moon is running an awareness campaign, Cao said, it will want to save money on CPMs to ensure it’s buying as many impressions as possible. Blueprint makes recommendations for implementing private marketplaces with low CPMs or adjusting bids to make the CPM lower.

Likewise, if Red Moon is optimizing click-through rates (CTR) for a lower-funnel campaign, Blueprint will recommend high-CTR marketplaces or suggest turning off audiences that are underperforming.

First-party first

The Blueprint feature is available to all Yahoo DSP clients within the existing dashboard. The first phase of implementation includes new data visualizations and audience insights, integration of an existing campaign forecasting tool, predictive audience modeling and customer lifetime value features. Yahoo plans to announce more updates next summer.

In addition, Yahoo’s Backstage direct publisher connection will be available as a supply source for Blueprint optimization if it fits a particular campaign’s needs.

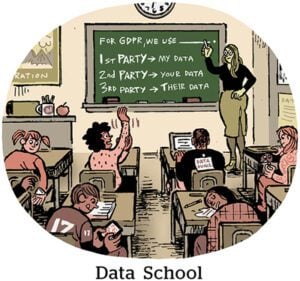

Yahoo is also emphasizing its own data set in its pitch for Blueprint because marketers are placing more value on partners with deep first-party pools, Herbst-Brady said. And using first-party data collected with user consent makes it easier to comply with privacy legislation.

To be clear, however, Blueprint does also draw on third-party data, and this data is given equal weight in its algorithmic decisioning.

For example, rather than relying on sales data from retailers, Blueprint is pulling data from digital receipts sent to Yahoo email accounts. That data can be anonymized and used to create targetable audiences and also help create lookalike audiences for similar purchases.

That email-based sales data is incredibly appealing to support Red Moon’s digital campaigns for CPG brands like Coca-Cola, Cao said.

In addition, Yahoo’s SDK integrations with location data providers Lifesight and Cuebiq allow its DSP to recommend targetable audiences of people who regularly visit certain areas, which is indispensable for driving consumers to physical stores, Cao added.

Inside the black box

While AI-driven optimization tools can be useful, transparency concerns abound regarding competitor products, like Google’s Performance Max and Meta’s Advantage+.

Yahoo wants to have an open dialogue with advertisers about the data its algorithm is using to make recommendations, Roodman said. Advertisers also have to opt in to any campaign adjustments, giving them final say.

While, according to Cao, Yahoo has been more transparent than its competitors when it comes to sharing what data goes into its algorithmic decisioning, his real concern is that these optimization engines will be threatened by privacy legislation if tech providers aren’t forthcoming about what user data is being collected and how it’s being used.

“If companies like Yahoo are able to bring more transparency to their optimization engine upfront, that’s a good precedent,” Cao said. “[But] we’re concerned about the longevity of a black-box system and how long we’re going to be able to get away with operating in an environment with little to no transparency.”

Update 12/5/23: Yahoo clarified that third-party data is given equal weight in Blueprint’s algorithm and not de-prioritized compared to Yahoo’s first-party data.