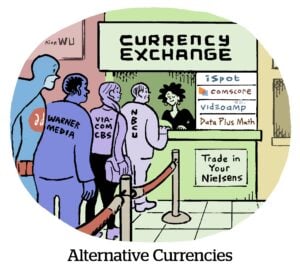

TV measurement has hit a tipping point.

The ad industry’s lofty ambitions for alternative currencies has plateaued, if not crashed Icarus-style back to Earth.

It’s not easy being an alt currency, though. (No offense, VideoAmp.)

New players struggle to gain market share because most buyers and sellers still transact on Nielsen numbers, even if both sides gripe about Nielsen and wish for other options.

Audience panels, meanwhile, are back on the measurement menu. New video currencies and panels were both popular talking points at CES in Las Vegas last week.

A cautionary tale

Challenging Nielsen is an uphill battle for alt currencies. But now that their novelty has waned, contenders must prove not only their ratings, methodologies and ROAS – but also that they have a fair and sustainable business model.

The case of VideoAmp is a cautionary tale for a few reasons.

The phrase “don’t grade your own homework” has become an ad tech cliché, but for good reason. VideoAmp is in the hot seat because, generally, advertisers don’t like it when companies dabble in both selling and measuring media – it’s a blatant conflict of interest. Higher viewership numbers could possibly inflate the price of campaign activation. For a ratings service, the incentive itself is a problem, even if the company promises measurement parity.

Video currencies must remove themselves from media sales – and, thus, a tempting growth opportunity – to compete for Nielsen’s core business.

Financial finagling

VideoAmp’s ad buying and measurement also landed it in a financial rut – exacerbated by extravagant spending on clients.

Tony Fagan, who was promoted to president of technology and strategy as part of the company’s restructuring this month, told me VideoAmp’s goal was to raise enough money from activation to fund its pivot into a video currency. He said measurement is the main priority.

The problem is that media activation is more lucrative and has more cash flow, whereas a currency business needs to mature and stabilize before it can generate profit.

Here’s an analogy inspired by one of my sources that depicts VideoAmp’s current situation: If you make most of your money selling Air Jordan shoes, and now you want to sell Crocs, you’re going to have to sell a whole lot more Crocs to make as much money as you did selling Air Jordans.

So … what happens to VideoAmp now?

Well, turns out its strong suits complement those of its primary competitor: iSpot.

While VideoAmp attracts new clients with campaign planning tools, iSpot is better known for cross-screen attribution and demo-based guarantees.

Which would explain why insiders claim the two had initial talks about a potential merger. Neither company confirmed these talks. But, in my opinion, it’s a potential merger that makes sense.

Panel vibes

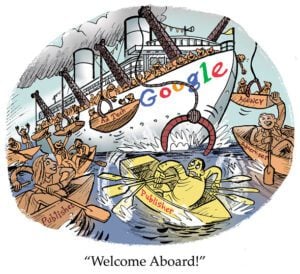

Speaking of mergers, consolidation is well underway in the currency space. (Exhibit A: iSpot acquiring competitor 605 in September.)

Earlier this month, Samba TV, another alt measurement provider, joined forces with the panel provider HyphaMetrics on a panel-based viewership product.

Specifically, HyphaMetrics is incorporating Samba’s viewership data (which encompasses about 3 million households) into an initial panel of 5,000 people by next year, with plans to eventually grow the panel to 10,000.

HyphaMetrics says its panel with Samba data should be cheaper to maintain than Nielsen’s panel because it can use in-house AI products to identify content on screen rather than paying to license automatic content recognition tech. The company also says its panel will be available to other measurement providers (and Nielsen competitors), including VideoAmp.

Panels are certainly back in style, Oscar Rondon, EVP of US product and partnerships at MiQ, told me at CES last week. But until recently, the newfound optimism for panels was specific to “calibration panels,” or small panels designed to supplement audience measurement for specific use cases. Essentially, programmers and agencies interpreted Nielsen undercounting audiences during the pandemic as a sign that audience panels don’t sufficiently capture streaming viewership.

But now, with alt currencies struggling to gain market share, Nielsen-style audience panels are back in vogue.

After all, audience panels are familiar to media companies and ad buyers.

What I’m wondering is: Will this new collab between HyphaMetrics and Samba TV produce a new force to be reckoned with amid the already shaky alt currency race?

Let me know what you think. Hit me up at [email protected].