Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

Hot On Netflix

Netflix isn’t stopping at WWE “Raw.” It’s licensing yet more content from the coffers of cable TV, including hit HBO show “Sex and the City” from Warner Bros. Discovery, The New York Times reports. The show will be available on Netflix in April.

The streamer plans to keep spending on original content, execs said during Netflix’s earnings call on Tuesday. But to stay ahead of the competition for subscribers and ad dollars, it also needs to nab fan favorites that historically live on linear TV. Until now, “Sex and the City” has only been licensed to cable networks.

Both WBD and Disney licensed titles to Netflix last year, a sign that their biggest adversary has a lead in the streaming wars – at least where revenue growth is concerned.

That isn’t to say licensing shows is an indication of failure: HBO titles licensed to Netflix still saw an uptick in viewership on WBD’s consolidated streaming service, Max, according to HBO Chairman Casey Bloys. And both HBO and Disney still offer the titles they licensed to Netflix last year. “Sex and the City” will also remain on Max in addition to Netflix.

May the best streamer(s) win.

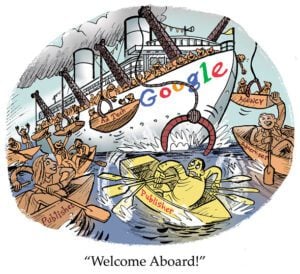

Peeling Away The Layers

After failing to sell its editorial brands as a whole, digital media company G/O Media is selling its portfolio for parts, Adweek reports.

That portfolio includes The Onion, Deadspin, Quartz, Kotaku, The Root and Gizmodo. (G/O Media is particularly intent on getting rid of The Onion because it’s not turning a profit, sources tell Adweek.)

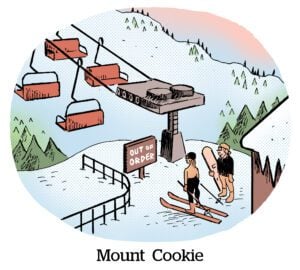

Times are tough for publishers, between declining referral traffic from search and social media platforms and third-party cookie deprecation threatening ad revenue. G/O Media’s traffic across its portfolio dropped precipitously from 33 million unique visitors in December 2019 to 21 million in December 2023, according to Comscore.

But private-equity-owned companies like G/O Media, which Great Hill Partners formed in 2019, are in a particularly tough spot. Last March, G/O Media sold Lifehacker to Ziff Davis for enough money to recoup its initial investment, and last November, it shut down Jezebel. Now it’s looking to cut and run altogether.

Because, as publishers know, PE firms are all about making a quick buck, not ensuring a pub’s long-term health or viability.

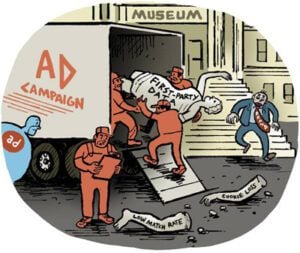

Deal With It

Last year was “one of the worst years ever” for ad tech M&A, according to LUMA’s Conor McKenna.

But industry experts think LiveRamp’s $200 million acquisition of data clean room Habu could signal that consolidation is back on the agenda for 2024, Business Insider reports.

M&A activity was hampered in 2023 by concerns about the economy and unsettled questions about the fate of third-party cookies. Now that the economy looks healthier and Google seems committed to its Privacy Sandbox cookie alternatives, companies are on firmer ground.

Some degree of consolidation is inevitable. Countless startups pitching third-party cookie alternatives have cropped up in recent years. But advertisers want end-to-end solutions, rather than relying on multiple ID providers and contextual products for targeting and a variety of attention and attribution vendors for measurement.

Which tech vendors will end up as acquisition targets remains to be determined. Retail media companies are still the hottest commodity on the market. The Habu deal, meanwhile, could trigger a run on clean rooms, even though they still aren’t widely used.

There’s also plenty of interest in ID companies, with ID5 at the top of that list. And LiveRamp could attract buyers now that it has Habu’s tech.

Isn’t it funny how M&A begets more M&A?

But Wait, There’s More!

The CNIL, France’s privacy watchdog, levied a $34.8 million fine against Amazon for excessive employee surveillance. [WSJ]

Netflix plans to fully phase out its cheapest ad-free (“Basic”) plan in countries where the ad-supported plan is available. [Variety]

NBCUniversal scored 2.8 million sign-ups for Peacock over the NFL Wild Card Game weekend. [Variety]

A vibe check on pre-upfront talks. [Marketing Brew]

Three Google DeepMind researchers exit to run their own AI startup called Uncharted Labs. [The Information]

The Network Advertising Initiative is working on updated guidelines for sensitive location data. [release]

Minute Media acquires online video platform STN Video for $150 million. [release]

You’re Hired!

GumGum names Frank Sueltmann as managing director of northern Europe. [release]

Raptive adds Mike Scatterday as SVP of creator commerce. [release]