Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

Ring Airer

Netflix is paying more than $5 billion for the rights to livestream “WWE Raw,” Variety reports. The 10-year deal is effective starting next January and represents Netflix’s biggest push into live content. Following a live sports debut with its “Netflix Cup” golf tournament in November, Netflix wants to make live sports a regular part of its programming slate.

Most live sports viewing still happens on linear TV – around 75%, according to MediaRadar – but the scales are tipping. Sports leagues are starting to see livestreams as essential for reaching as many fans as possible.

This is a new mentality for sports leagues. WWE kept the live airing of “Raw,” its flagship show, exclusive to the USA Network before letting NBCUniversal, its former streaming partner, upload the episodes to Peacock. The idea was that a window of exclusivity would prevent streaming services from cannibalizing reach and ad revenue from the live airing (not unlike “theatrical exclusivity” before movies can be streamed).

But now sports leagues realize they’re missing out on massive reach numbers – and ad dollars – if they leave livestreams out of the ring.

Shark Bait

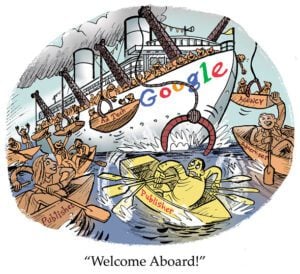

Scammers are reeling in consumers with fake Google search ads for “Shark Tank” keto gummies, Mashable reports.

According to a report from ad tech watchdog Check My Ads, the gummies show up in both Google sponsored ads and organic search results. They rank above results that might alert consumers to the scam, including articles exposing it and an FTC warning about false product endorsements.

The purported weight loss gummies claim to have approval from “Shark Tank’s” judges, but not only is the product not “Shark Tank”-approved; it also doesn’t work.

None other than Mark Cuban himself brought the scam to the attention of Check My Ads Co-Founder Nandini Jammi after fielding complaints from disgruntled customers.

A number of the swindlers use Google Analytics to monitor how people find their website and adjust their ad campaigns accordingly to reach more victims. They sometimes even create fake review sites with glowing praise for the gummies, using Google Ads to make money through Adsense.

The grifters wouldn’t succeed in pushing their product without Google. But as Check My Ads points out, Google loses ad revenue by cracking down on scam search ads, meaning it won’t change unless it’s forced to.

Until then, we’ll all be swimming in fake shark-infested waters online.

Prime Paddles Upstream

Amazon is the third-largest digital advertising company, behind only Google and Meta – but that doesn’t mean it’ll be smooth sailing for Amazon Prime Video’s soon-to-launch ads business.

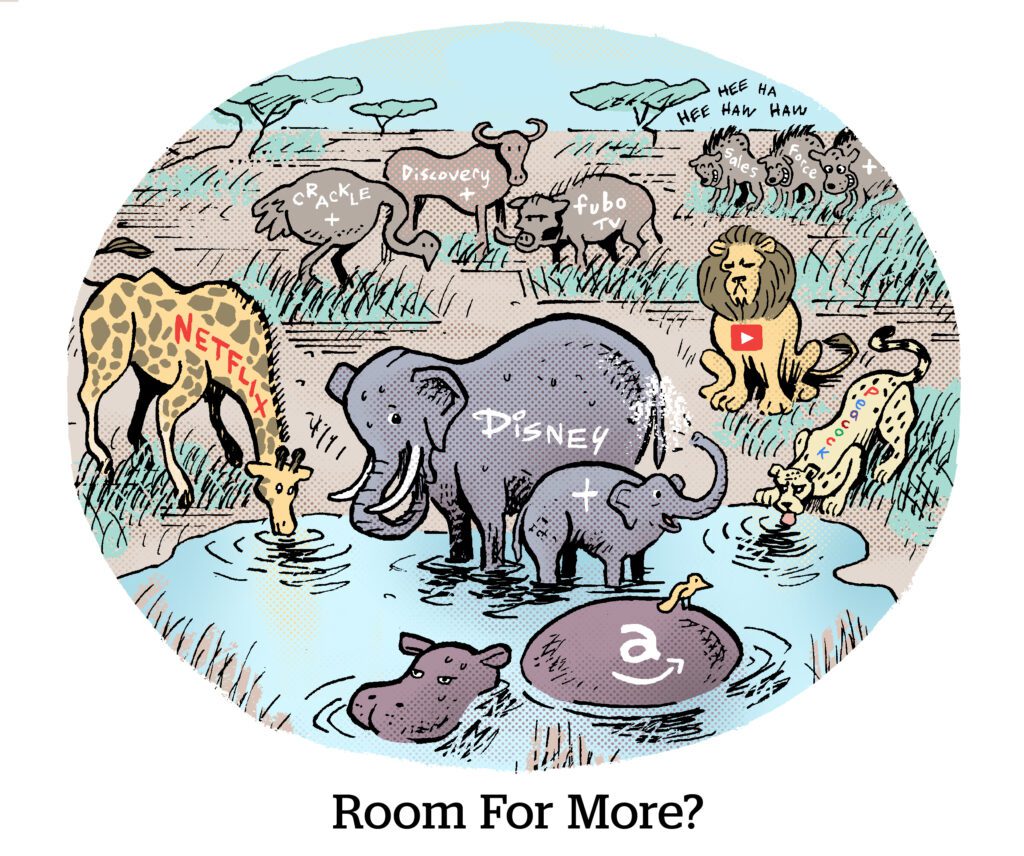

Industry watchers say Amazon faces serious challenges as it enters the increasingly crowded ad-supported streaming market, The Wall Street Journal reports.

Thanks to its dominance in ecommerce and its wealth of online shopping data, Amazon has cornered the majority of retail media spend.

But brands in TV’s top-spending verticals – like fast food, automotive and financial services – usually don’t sell products on Amazon. So Amazon’s online shopping bona fides won’t be helpful as it courts nonendemic brands.

Plus, Amazon’s focus on performance up to this point could give brand advertisers pause.

Even endemic advertisers in the fashion, beauty and CPG categories might think twice about buying ads on Prime Video since Amazon has its own competitive house brands.

And many of Amazon’s streaming competitors, such as Disney and Warner Bros. Discovery, already have long-standing relationships with legacy TV advertisers.

But perhaps the biggest hurdle for Prime Video is that it lags behind other streamers when it comes to premium content. Flops like “The Rings of Power” won’t attract Netflix-sized CPMs.

But Wait, There’s More!

Podcast networks like Acast, iHeartMedia and Spotify are testing AI tools for ad sales, translation and production. [Digiday]

Brian Wieser: The impact of Netflix’s ads business on its competition. [Substack]

The LA Times will lay off 115 staffers, citing shortfalls of between $30 million and $40 million. [Variety]

TikTok cuts 60 positions, mostly in sales and advertising. [NPR]

Why some advertisers are skipping the national Super Bowl broadcast in favor of TelevisaUnivision’s Spanish-language simulcast. [Ad Age]

You’re Hired!

IPG names Lisa De Bonis as CEO of creative consultancy Huge. [release]

Digital marketing firm Incubeta makes Alex Langshur CEO of its operations in the Americas. [release]

Equativ appoints Parag Vohra as CRO and promotes Jean-Christophe Peube to COO and Teiffyon Parry to CSO. [release]

Hemisphere Media Group names Jimmy Arteaga Grustein as its chief content officer. [The Weekly Journal]

Angela Barrett joins LG Ad Solutions as head of corporate communications. [release]