Crunchtime

The EU’s Digital Markets Act has teeth – and now it’s biting, TechCrunch reports.

The DMA regulates anti-competitive practices within “gatekeeper platforms” that have an annual turnover of at least 7.5 billion euros. Meta, Apple, Alphabet, Amazon, Microsoft and ByteDance all tick that box. Gatekeepers have until March to ensure their operations in the EU are in compliance.

On Monday, Meta shared a blog post detailing how it plans to respond: by allowing people to choose how their data is shared (or not) between different Meta-owned services.

If, for example, someone clicks on an ad for shoes on Facebook, they can stop that same pair of shoes from following them around on Instagram. Meta will notify EU users about account separation over the next few weeks.

Naturally, more opt-outs will chip away at Meta’s targeted advertising empire, although this isn’t its first rodeo. Although Apple’s AppTrackingTransparency was a blow, Meta has mostly lapped the aftereffects.

But it’s not like Meta has a choice here. As it notes in its blog post: “We are offering these choices to address the requirements of the DMA.”

And so are other behemoths. Apple’s recent plans to enable third-party app downloads on its devices in the EU points to the pressure all “gatekeepers” are under.

Clouding The Issue

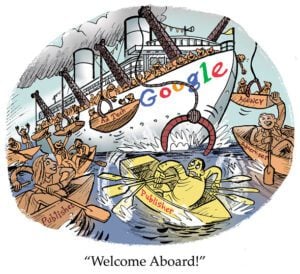

Speaking of trying (or claiming) to play more fairly with competitors, let us now turn to Google.

While its cloud-computing service isn’t on the DMA’s hit list just yet – Google Cloud has only 7.5% market share, according to Gartner – over in the US, the FTC considers data migration fees to be a potential concern when it comes to fair cloud competition.

So, earlier this month, Google Cloud removed the fees its customers pay to transfer their data into another cloud platform – but some critics aren’t satisfied, The Wall Street Journal reports.

“Egress fees,” as they are known, will only be waived if customers end their contract with Google Cloud, according to the fine print. (So much for dual citizenship.)

That caveat is a problem because brands and agencies need multiple cloud integrations to match their campaign data within walled gardens and across the open web. More likely than not, many customers will just keep paying the fee so they can maintain a relationship with Google Cloud.

Although on its surface, removing exit fees might appear to give companies more freedom to explore which cloud platforms work best for them, Google’s move ultimately does little to address the financial burden of managing a cross-cloud approach.

It’s Still The Economy, Stupid

If you thought marketers were ready to leave their economic doom and gloom behind in 2023, guess again!

S4 Capital says we’re in for another year of cautious ad spending, The Drum reports.

In a recent update on the company’s Q4 financials, Sir Martin Sorrell, executive chairman of S4, which owns digital agency Media.Monks, said to investors, “We are not expecting 2024 to show macroeconomic improvement.”

Sorrel says 2023 represented a “difficult year” for S4 after four consecutive years of growth. The company’s revenue dropped 4% YOY, caused mainly by a pullback in spending by tech advertisers and fewer small project-based campaigns.

And don’t expect those trends to reverse anytime soon, according to Sorrell.

S4’s assessment differs from some other recent ad industry projections for 2024. The most recent IPA Bellwether Report hinted that advertisers are ready to start spending again. But even if ad spend returns, last year’s pullbacks mean most agencies aren’t exactly in growth mode yet.

And besides, says Barry Dudley, a partner at advisory firm Green Square, any optimism for the coming year could be blunted by continuing advertiser concerns around the upcoming elections and coverage of ongoing conflicts.

But Wait, There’s More!

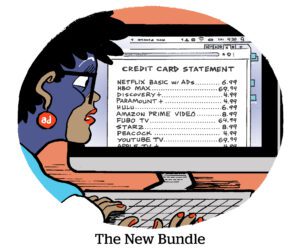

Paramount has decided to forgo a glitzy upfront presentation in favor of private client meetings for the second year in a row. [Variety]

Speaking of Paramount, sports programming is behind a recent surge in Paramount+ app installs. [h/t @eric_seufert]

Netflix is pulling back on original films as it focuses on advertising and subscriber gains. [Business Insider]

Charter Spectrum is bundling TelevisaUnivision’s ad-supported streaming service with linear TV. [Hollywood Reporter]

Google courts outside investors to fund its moonshot projects division, X (not to be confused with Musk’s thing), as it continues downsizing with more staff cuts. [Bloomberg]

You’re Hired!

Sharb Farjami becomes the next CEO of GroupM North America, following Kirk McDonald’s departure last year. [Ad Age]

Teads names Damien Islam-Frenoy as its CTO. [Adweek]