Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

Commerce Copycats

The Wild Man Drinking Company (which makes a novelty item called the Krak’in used for shotgunning beers) filed a patent-infringement lawsuit against Temu last week (H/t @Sean Frank, CEO of the wallet brand Ridge).

Why’s that interesting?

Temu frames itself as a “passive” platform. It isn’t responsible for sales, like how Craigslist or Facebook Marketplace don’t stand behind listings in their bazaars.

Except, in this case, Temu advertised the knockoff items as “Krak’in” products. (It’s worth noting that Temu removed the infringing products from its platform last month.)

But there’s a potential playbook for other brands here, since Temu outbids everyone other than Amazon for shopping keywords and can be prompted to show falsely portrayed brand names, like Lego, Cuisinart and AirPods.

Unrelated, Krak’in’s case is interesting because machine-learning-based ad products will increasingly self-operate things like product listing copy and search metadata inputs.

Conquesting another brand’s organic search terms is kosher. Stuffing product metadata with rival brand terms is … OK, we guess. But what if those terms then display in searches?

Tactics that can be justified in the name of performance will invariably attract machine-learning algos, whereas human observers would immediately call it off.

Prime Cuts

Amazon is negotiating deals ahead of the introduction of Prime Video ads at the end of the month, Adweek reports.

Advertisers will have three options to buy Prime inventory. The cheapest way will be preferred deals at a baseline $26 CPM via Amazon’s DSP. Buyers won’t be guaranteed inventory, but can target Amazon audiences by genres or titles.

Alternately, guaranteed buys through Amazon’s managed service range between $34 and $41 depending on whether the campaign targets basic age and gender demos or gets into interest-based segments (think diaper-buying “new parents” or address-changing “recent movers”).

Contextual ads for the top 200 titles on Prime will carry $37 CPMs.

Big spenders can also pay to sponsor an entire program without any other ads. Depending on the program, that price tag can be anywhere between $600,000 to $8 million – and considering Amazon’s recent push for sports programming, premium sponsorships will seemingly cost millions.

Although, for once, Amazon’s selling point isn’t the marketplace purchase data. This time, it’s pure scale.

Prime Video will default to showing everyone ads (subscribers can pay an additional $2.99 per month to go ad-free), so Amazon claims ads could reach 115 million viewers out of the gate.

European Protectionism

The online consumer experience in Europe is splintering from the US.

This has been true of pop-up consent notifications, but Apple will soon relaunch European iPad and iPhone devices to allow third-party app store downloads (what was illicitly dubbed sideloading) and alternative payment methods.

There will be a distinct version of the App Store for devices sold in Europe.

Android, meanwhile, will have new screens that provide options for a default browser and search engine, rather than defaulting to Chrome and Google. Google Search pages will also show fewer Google-controlled vertical shopping units while increasing links to third-party sellers. Google Travel will disappear entirely. (More traffic should organically flow to ticket sellers.)

The European Parliament this week also proposed a measure that would require streaming audio like Spotify and Apple Music to promote domestic artists to listeners in Europe.

On the other hand, these changes and others taken by Google – and Apple, in particular – illustrate an “unshakeable sense of entitlement,” writes John Gruber at Daring Fireball.

Court orders won by regulators are regularly flouted and disregarded to the very legal edge, if not beyond.

But Wait, There’s More!

Apple may open Apple Pay tech to other systems so they can use mobile wallet checkout. [WSJ]

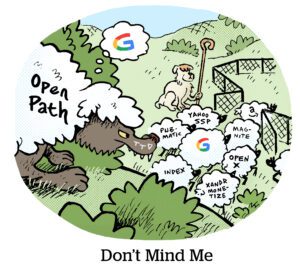

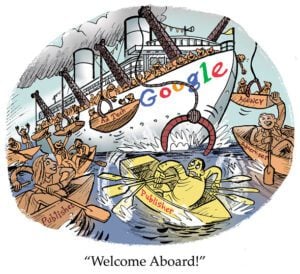

The post-cookie battle between Google and The Trade Desk – and why ad tech companies are taking sides. [Ad Age]

Brian Wieser: Reddit, Disney, streaming video and other media miscellany from the week. [Madison and Wall]

The Arena Group lays off Sports Illustrated staff after missing a payment to the publication’s license holder. [Front Office Sports]