Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

Don’t Look For Me

The FTC isn’t slowing its crackdown on location data brokers.

On Thursday, it issued a complaint against InMarket for failing to obtain informed consent from users on its own apps and third-party apps that use InMarket’s SDK before collecting consumer data and building profiles to use for targeted advertising.

This complaint marks the agency’s second case in recent weeks over unfair collection of location data. Earlier this month, the FTC settled its case against X-Mode Social and its successor, Outlogic. Kochava, meanwhile, refuses to settle, so that case is still ongoing.

With InMarket’s case, the FTC proposes banning it from selling or licensing any precise location data. If the FTC wins this case, InMarket would have to delete or anonymize all data it collected without consent and notify users whose data was collected improperly. It would also have to create comprehensive data privacy and retention policies, plus find a simple way for consumers to withdraw consent for InMarket to collect or use their location data. Consumers should also have a way to request that their data be deleted, which follows where other state-level laws are going.

The Secret Of Success

Ben Thompson of Stratechery has a wide-ranging Q&A with Om Malik, a tech industry analyst and venture capitalist. We will focus on a small, pithy portion that touches on advertising.

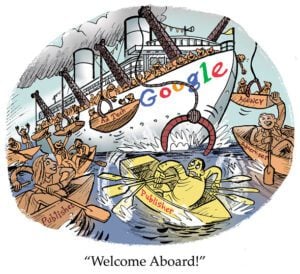

Google’s various owned-and-operated properties are now so large and so lucrative that the company is trapped inside itself.

Now all Google does is ask: “How do we monetize this one machine as much as we can?” And that machine is advertising, Malik says.

Advertising paid for Waymo, for instance, he says, but Google’s decade-long investment in mapping and directions apps (Maps and Waymo) is simply a thing of the past.

Google has the curse of the cash cow. The company has shed its moonshots, built its hero consumer products and now has nothing left to do but make the advertising revenue number go up.

“I think that’s a bigger problem they have than anything else,” Malik says of Google’s myopic focus on ad revenue, “but we don’t have enough time to go into that.”

Tune In, Check Out

Streamers and CTV companies have a yen for shoppable TV, Ad Age reports.

An outgrowth of infomercials and the QVC shopping network, shoppable TV allows viewers to browse and buy the products they see either on their TV or through their phones.

Also called TV commerce, shoppable advertising often takes the form of interactive ad spots. Viewers can scan QR codes, get phone notifications or click to purchase with their remotes without navigating away from the TV screen. Shoppable TV might also combine some old-fashioned product placement with overlay menus where viewers can purchase the products featured in the show they’re watching.

NBCUniversal’s Peacock, Disney, Amazon Prime and AMC Networks have tried their hand at shoppable ads. So has Roku, which has teamed up with companies like DoorDash and Walmart. Walmart even worked with Roku on a faux holiday rom-com series, “Add to Heart,” featuring 330 shoppable products.

Traditionally, TV ads have been more of an upper-funnel play for brands. But the pressure’s on to tie TV investments to revenue gains. Shoppable ads are one way TV companies are trying to do that.

But Wait, There’s More!

Reddit seeks to launch its IPO in March. [Reuters]

Google CEO: Layoffs will continue through 2024. [The Verge]

Why activist investor Nelson Peltz says Disney should target Netflix-like profit margins. [The Information]

Mike Shields: Sports has a Gen Z problem. Can Amazon help? [Substack]

What’s in store for mobile gaming inventory this year. [Digiday]

You’re Hired!

Jim Spadafore joins Scripps Sports as senior director of revenue. [release]

The Trade Desk makes Tim Sims its chief commercial officer and promotes Jed Dederick to chief revenue officer. [release]

Blockboard names Carlos Restrepo as chief revenue officer. [release]

LoopMe brings on Robin Porter to lead its new political advertising division. [release]