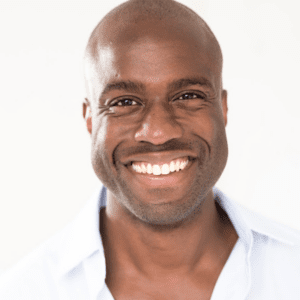

Google’s Matt McDonald will be speaking at CTV Connect on March 13-14 in New York. Click here to register.

Ten years ago, YouTube was just a place to watch video clips.

To keep up with changing consumption habits, YouTube is now streaming TV and video in as many ways as possible – from linear programming on YouTube TV to the social media-style experience of YouTube Shorts.

Advertisers, meanwhile, have become more selective about how they find and reach their audiences.

Specifically, brands are looking to move down the funnel with their streaming campaigns and achieve outcomes beyond reach and frequency, including on YouTube, said Matt McDonald, Google’s global head of connected TV and streaming.

Branding is good, but advertisers need to prove performance to justify their streaming spend. And one way to do that, McDonald said, is through newer, more interactive ad units.

The buy side’s growing focus on performance for streaming ads is why YouTube joined GroupM’s Ad Innovation Accelerator working group in January, which the agency formed to create technical standards for new CTV ad units in collaboration with streaming and ad tech companies.

“Ultimately,” McDonald said, “the goal is to deliver the outcomes advertisers are looking for and [to do it] at scale.”

McDonald spoke with AdExchanger.

AdExchanger: How does YouTube differentiate its ads strategy based on content type?

MATT MCDONALD: User experience varies based on the format of the content. Connected TV is still very much a lean-back experience, for example, so viewers prefer fewer ad breaks where longer commercials are more acceptable. It’s why we rolled out 30-second nonskippable ads for YouTube Select [which is made up of the top 5% most viewed content on YouTube] last year.

In comparison, YouTube Shorts are better suited for shorter, pithier, more engaging ads.

Why might advertisers prefer particular ad formats over others?

For brands that want to build awareness, nonskippable ad units perform well. But advertisers that are more focused on driving online sales or lead generation turn to other types of ad options, such as brand sponsorships.

We’re experimenting with newer ad formats like pause ads and adding QR codes to more creative.

Why do brands want newer ad formats?

New ad formats can help lower frequency saturation. If viewers engage with more interactive ad formats, brands could reduce the potential for wastage and spread their budgets accordingly to reach new viewers.

[Editor’s note: Viewers also feel less bombarded by ad frequency when there’s more variety in creative.]

Which nontraditional ad formats are most popular with brands?

We’re seeing growth in brand sponsorships because they’re an effective way to reach viewers when they’re in a particularly engaged state.

One example is an ad offering [Moment Blast, which YouTube launched in 2022] that lets brands reserve the first ad spot in a viewing session of YouTube Select content [which often includes tentpole events].

We’ve also been testing similar sponsorship ad formats designed for longer binge-viewing sessions because YouTube’s research suggests viewers who are binge-watching are more receptive to ad formats that aren’t as interruptive as traditional ad breaks.

What are some of the challenges with newer ad formats?

[As an industry, we] need to make sure there’s consistency from a technological standpoint, meaning standard specs for newer CTV ad formats. Otherwise, brands would need different creatives for each publisher, which isn’t scalable.

How does YouTube measure different ad formats?

For skippable ads, we count 30 seconds of viewing as a billable impression. But for YouTube Shorts, we consider 10 seconds of viewing as an appropriate benchmark for a quality impression. [Editor’s note: Shorter content with a scrolling element can make it harder to capture people’s attention.]

How does YouTube tell whether someone’s actually watching when skippable ads play out in full?

We use a variety of signals to make sure there’s some level of user engagement behind billable impressions. Based on how viewers interact with their devices, such as by turning the volume up or down, for example, we can estimate user engagement to help measure whether an ad drove the results an advertiser is looking for.

We also help advertisers plan campaigns with ad formats that take user engagement into consideration. For example, we introduced audio ads we can run if users are listening but may not be fully watching the screen.

How is YouTube approaching the need for measurement standardization in TV and streaming?

We’re continuing to look for new measurement partners and investing in supporting cross-media measurement standards.

Ultimately, the goal is for customers to get strong results that can be measured by third parties, not just by us.

This interview has been lightly edited and condensed.