Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

Board Games

The LG Ads board of directors has three new members. Or, more accurately, two previous board members – Alphonso co-founders Ashish Chordia and Lampros Kalampoukas, who were fired as part of an orchestrated corporate coup in late December 2022 – have been reinstated. The third new member, a venture capitalist named Paul Falzone, was an early investor in Alphonso, the ad tech company that LG Electronics (LGE) bought in 2021 and later rebranded to LG Ads.

A refresher for those who haven’t been following the drama: A group of minority Alphonso shareholders sued LGE last year for board malfeasance, accusing the TV manufacturer of booting Alphonso-friendly board members in an attempt to renege on its original shareholders agreement, which gave Alphonso the opportunity to take itself public within five years.

Earlier this month, the Delaware Chancery court found in favor of the plaintiffs, who were given the right to restore three minority-appointed directors.

With Chordia and Kalampoukas back on the board and Falzone newly added, what’s next for Alphonso? We may just see its stock ticker in the not-too-distant future.

If It Ain’t Broke, Don’t Flix It

Ben Thompson at Stratechery landed a hard-to-snag interview with Netflix co-CEO Greg Peters, who’s been profiled or interviewed very little considering his powerful Hollywood position.

Peters is refreshingly candid, acknowledging that Netflix’s password-sharing crackdown was timed to knock people into the ad-supported tier (which, duh, but CEOs tend to deny or deflect).

Peters joined Netflix when it was still a DVD shipper – and at a pivotal moment, when Netflix had just spun off Roku. (Roku’s founder, Anthony Wood, had worked for Netflix on a potential streaming TV device.)

Peters says the rationale behind spinning off the Roku biz was to go all in on distribution. Because why make proprietary hardware when you can be a button on every smart TV remote? Plus, cable companies can bundle Netflix since they have little competitive tension.

Peters also gets into Netflix’s recent evolutions.

For instance, Thompson frames Netflix’s gaming business as a nice-to-have potential revenue stream, which is different from changes that were motivated by existential dread.

“Nothing motivates like a crisis,” Peters says, “and no crisis should be wasted.”

The best example of that, he notes, is ads.

Advertising also brought Netflix and Roku back together – but this time as competitors.

Drop In For A Chat

Chatbot-generated text and images are slowly transforming search engines as we know them. To be fair, this won’t be an overnight change and may never happen organically. Rotary phones and dial-up internet had to be forcibly taken away from hundreds of thousands of people before they adopted the alternatives en masse.

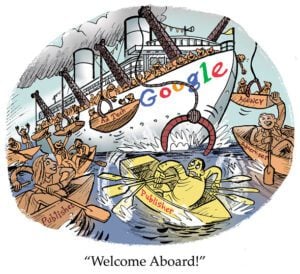

But one thing is certain: The news industry loses as a result of the chatbot trend.

Today, 88% of reputable news publishers – from daily newspapers and magazines like The Atlantic to digital publishers, such as Bleacher Report – block chatbot web crawlers. (ChatGPT’s crawler is the most blocked.)

That’s not a shock, considering The New York Times just sued OpenAI and Microsoft over instances of blatant plagiarism by ChatGPT after it and other generative chatbots lifted original content and reporting wholesale from news sites and confidently presented it as its own.

Yet this type of bitter pill is one that news publishers might just be forced to swallow.

If they don’t embrace AI, they risk missing a critical new distribution channel. The vast majority of publishers allow search crawlers, after all.

And chew on this: Many of the publishers that do allow generative AI crawlers tend to be conservative media. As a result, readers who prompt generative AI for news could end up getting lower-quality information, if not outright misinformation.

But Wait, There’s More!

TikTok is testing horizontal videos for some accounts [h/t @Jules_Terpak] and will allow videos of up to 30 minutes long. [Mashable]

No long-tail publishers, CPMs or CPAs: What digital advertising should leave behind in 2024. [Adweek]

NBCUniversal’s Peacock grew ad revenue by 28% YOY last quarter – a material driver of Comcast’s overall TV ad revenue growth. [CNBC]

WPP unites BCW and Hill & Knowlton to create a new comms agency called Burson. [release]

You’re Hired!

Ad resource management service MINT names Lorenzo Larini as its new global CEO. [release]

Olivia Oshry joins OAAA, the outdoor advertising industry’s trade body, as VP of marketing. [LinkedIn post]